with our monthly newsletter.

It seems intuitive that during a recession, companies need to cut overhead, and Corporate Social Responsibility (CSR) and sustainability programs may be the first to go. However, looking at the Great Recession of 2007-2009 in the United States, data suggests that this thinking is flawed: not only did many companies continue to invest, but those that put sustainability at the core of their operations actually weathered the recession better than those that did not.

Environmental Sustainability Increased During the Recession

As might be expected, the initial crash in 2007 was followed by a significant decline in corporate responsibility spending, with companies opting to fund particular programs instead of investing in a full CSR department or future innovations. However, a more nuanced view shows that many firms maintained or even accelerated sustainable practices that focused on environmental impact. For example, recycling was one cost-cutting measure that enabled companies to gain operational efficiency.

It appears that firms tended to shift their sustainability strategy in innovative ways that allowed them to create more impact with fewer resources. This adaptation enabled companies to compete more effectively, strengthening capabilities with existing resources.

The 2007 recession demonstrated to C-Suite executives the real financial risk that resource scarcity poses to their businesses: there was a sharp increase in the price of core commodities like oil, iron, and wheat while supplies of food, water, and energy fell. Since then, they have chosen to engage in more sustainable measures in resource efficiency to combat that risk.

"Companies that put sustainability at the core of their operations actually weathered the recession better than those that did not."

High Sustainability vs. Low Sustainability

We know environmental sustainability investments can make sense during a recession, but what about social sustainability? What is the value of sustainable programs during tight economic times? At the end of the day, how can a business be persuaded that sustainability is core to its ability to survive and recover from a recession?

Business professors Robert Eccles, Ioannis Ioannou, and Palladium Thought Leader George Serafeim attempted to answer this question in their 2014 paper, which looked at corporate sustainability practices and their relationship with long term performance.

Out of 180 companies they studied, half identified environmental and social sustainability as core to their corporate strategy as early as 1993. These are “High Sustainability Companies.”

The other half were identified as having adopted no sustainable practices over the entire studied period, from 1992 to 2010. These focused only on profit maximisation, with environmental and social sustainability being viewed as external to their corporate strategy. These are “Low Sustainability Companies”.

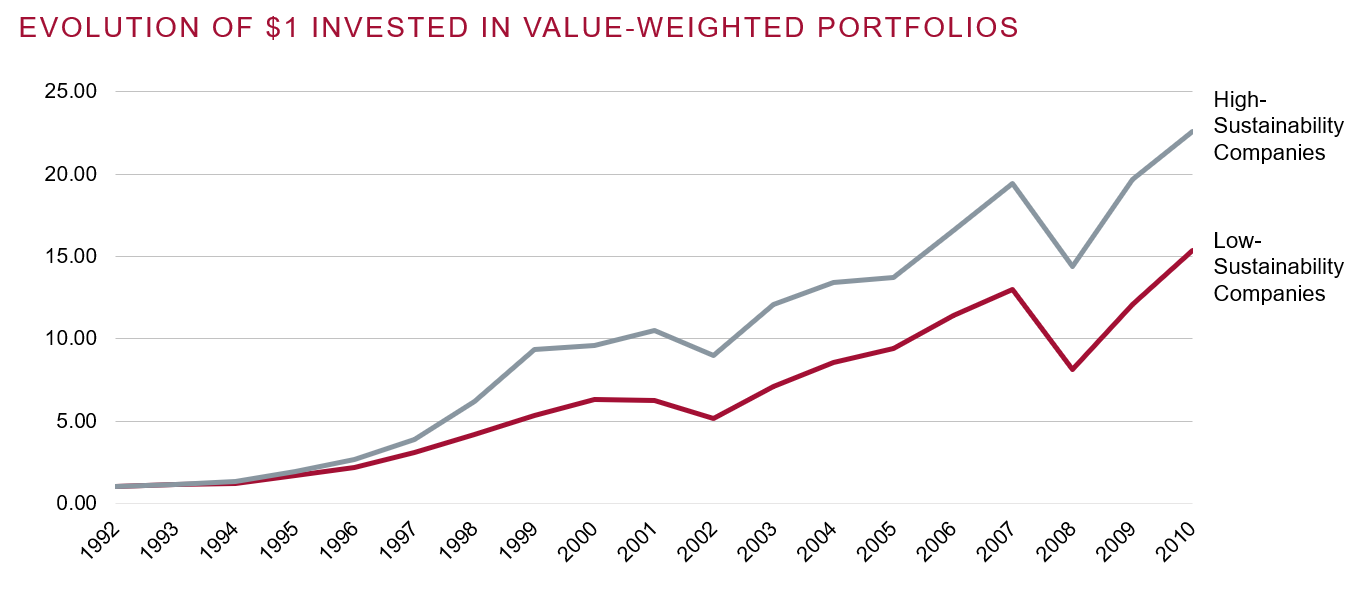

Results showed that if you invested $1 in an equally-weighted portfolio of the 90 High Sustainability Companies in 1992, that investment would have grown to USD 22.60 by the end of 2010.

In contrast, the Low Sustainability Companies, given the same equally weighted investment made in 1992 among all profit maximising companies, would only have the investment grow to USD 15.40 by the end of 2010.

The analysis showed that over the long run, even in the immediate aftermath of a recession, those 90 High Sustainability Companies were actually more capable of profit maximisation than the 90 Low Sustainability Companies who ignored sustainable practices to solely focus on profit maximisation.

Looking at 2008 to 2010, this study shows that the High Sustainability Companies recovered from the recession much more quickly:

- High Sustainability: a 2008 low of $14.39 to a 2010 high of $22.58

- Low Sustainability: a 2008 low of $8.14 to a 2010 high of $15.35

The High Sustainability Companies increased $8.19 versus the Low Sustainability Companies’ $7.21.

Inclusive Growth

How can a corporation integrate sustainability into the core of its strategy? The key is to adopt “inclusive growth” principles for your business.

An inclusive growth business is one that goes beyond traditional corporate social responsibility initiatives to create profoundly different ways of achieving core commercial objectives while generating positive impact at scale.

For example, imagine a multinational chocolate manufacturer who develops stronger relationships within its agricultural ecosystem, ultimately resulting in increased technical knowledge, higher quality cocoa outputs, improvements in quality of life for smallholder farmers, and increased transparency within its value chain. Inclusive growth practices enable “win-wins” where the primary company is improving the quality of their service or product, and external stakeholders are similarly profiting.

The execution of inclusive growth principles through alignment of stakeholder relationships can be key to a company’s resilience, and a profitable practice to have in place during periods of economic expansion. Companies that have prioritised both economic and social sustainability as core to their business practice have consistently outperformed their peer companies. While many can easily argue for environmental initiatives to achieve bottom line efficiency, a more comprehensive inclusive growth strategy would increase that company’s longevity, profitability, and engagement with key stakeholders.

The numbers are in: sustainability is a competitive advantage on which all companies should capitalise.

Attend the “Kaplan-Norton Strategy Execution Boot Camp: Positive Impact and the Execution Premium Process” to understand how your company can develop and execute a winning strategy with Inclusive Growth principles.

with our monthly newsletter.