with our monthly newsletter.

Source: KKS Advisors

In response to emerging challenges and demands from consumers and employees, a growing number of companies across the globe are implementing sustainability practices – often characterised as environmental, social, and governance (ESG). In a new report, Harvard Business School professor Dr. George Serafeim and his co-authors look at the top 100 international banks to test the relationship between ESG and financial performance within the commercial banking industry.

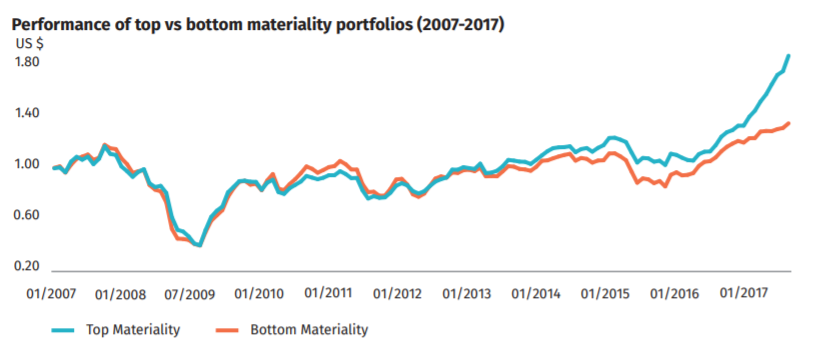

According to the report, not all ESG issues are equal from industry to industry, and by focusing on “material” investments (i.e., those that are most likely to directly impact the company’s financial or operating performance) vs. “immaterial”, commercial banks financially outperform their competitors by an average of 2.65%.

For the banking industry, these material categories include labour practices, diversity and inclusion, data security and customer privacy, business ethics, fair marketing and advertising, and more.

The results are not as pronounced when looking at immaterial ESG, which for banks includes categories such as water resource management and business model resilience. Banks scoring higher on immaterial ESG practices do not always outperform those with lower scores, suggesting that there is no competitive edge to be gained from investing in immaterial ESG. This does not show that banks focusing on these ESG issues lose money – rather, they simply don’t realise the same benefits as banks that focus on material ESG issues.

These findings are particularly noteworthy for investors. Applying a material vs. immaterial lens can help them to identify the ESG practises that can lead to the biggest financial returns, promoting the practices that will continue to deliver more impact.

“Raising the bar on transparency around ESG metrics creates a race to the top.”

Serafeim, who has also co-authored articles for HBR with Palladium thought leaders, sees a wide application for this research. “Raising the bar on transparency around material, comparable, and reliable ESG metrics creates a race to the top and to innovation instead of a race to the bottom within the business community,” he says.

A corporate focus on ESG and sustainability is here to stay, and this report provides further evidence that adopting a strategic focus on ESG issues goes beyond CSR and traditional notions of corporate sustainability – it’s a clear path to financial outperformance.

Dr. George Serafeim is co-author of the HBR article “Inclusive Growth: Profitable Strategies for Tackling Poverty & Inequality” with Palladium’s Eduardo Tugendhat and Dr. Robert Kaplan. Contact info@thepalladiumgroup.com to learn more.

with our monthly newsletter.